Trade for you! Trade for your account!

Direct | Joint | MAM | PAMM | LAMM | POA

Forex prop firm | Asset management company | Personal large funds.

Formal starting from $500,000, test starting from $50,000.

Profits are shared by half (50%), and losses are shared by a quarter (25%).

Forex multi-account manager Z-X-N

Accepts global forex account operation, investment, and trading

Assists family office investment and autonomous management

Foreign exchange investment manager Z-X-N accepts entrusted investment and trading for global foreign exchange investment accounts.

I am Z-X-N. Since 2000, I have been running a foreign trade manufacturing factory in Guangzhou, with products sold globally. Factory website: www.gosdar.com. In 2006, due to significant losses from entrusting investment business to international banks, I embarked on a self-taught journey in investment trading. After ten years of in-depth research, I now focus on foreign exchange trading and long-term investment business in London, Switzerland, Hong Kong, and other regions.

I possess core expertise in English application and web programming. During my early years running a factory, I successfully expanded overseas business through an online marketing system. After entering the investment field, I fully utilized my programming skills to complete comprehensive testing of various indicators for the MT4 trading system. Simultaneously, I conducted in-depth research by searching the official websites of major global banks and various professional materials in the foreign exchange field. Practical experience has proven that the only technical indicators with real-world application value are moving averages and candlestick charts. Effective trading methods focus on four core patterns: breakout buying, breakout selling, pullback buying, and pullback selling.

Based on nearly twenty years of practical experience in foreign exchange investment, I have summarized three core long-term strategies: First, when there are significant interest rate differentials between currencies, I employ a carry trade strategy; second, when currency prices are at historical highs or lows, I use large positions to buy at the top or bottom; third, when facing market volatility caused by currency crises or news speculation, I follow the principle of contrarian investing and enter the market in the opposite direction, achieving significant returns through swing trading or long-term holding.

Foreign exchange investment has significant advantages, primarily because if high leverage is strictly controlled or avoided, even if there are temporary misjudgments, significant losses are usually avoided. This is because currency prices tend to revert to their intrinsic value in the long run, allowing for the gradual recovery of temporary losses, and most global currencies possess this intrinsic value-reversion attribute.

Foreign Exchange Manager | Z-X-N | Detailed Introduction.

Starting in 1993, I leveraged my English proficiency to begin my career in Guangzhou. In 2000, utilizing my core strengths in English, website building, and online marketing, I founded a manufacturing company and began cross-border export business, with products sold globally.

In 2007, based on my substantial foreign exchange holdings, I shifted my career focus to the financial investment field, officially initiating systematic learning, in-depth research, and small-scale pilot trading in foreign exchange investment. In 2008, leveraging the resource advantages of the international financial market, I conducted large-scale, high-volume foreign exchange investment and trading business through financial institutions and foreign exchange banks in the UK, Switzerland, and Hong Kong.

In 2015, based on eight years of accumulated practical experience in foreign exchange investment, I officially launched a client foreign exchange account management, investment, and trading service, with a minimum account balance of US$500,000. For cautious and conservative clients, a trial investment account service is offered to facilitate their verification of my trading capabilities. The minimum investment for this type of account is $50,000.

Service Principles: I only provide agency management, investment, and trading services for clients' trading accounts; I do not directly hold client funds. Joint trading account partnerships are preferred.

Why did foreign exchange manager Z-X-N enter the field of foreign exchange investment?

My initial foray into financial investment stemmed from an urgent need to effectively allocate and preserve the value of idle foreign exchange funds. In 2000, I founded an export manufacturing company in Guangzhou, whose main products were marketed in Europe and the United States, and the business continued to grow steadily. However, due to China's then-current annual foreign exchange settlement quota of US$50,000 for individuals and enterprises, a large amount of US dollar funds accumulated in the company's account that could not be promptly repatriated.

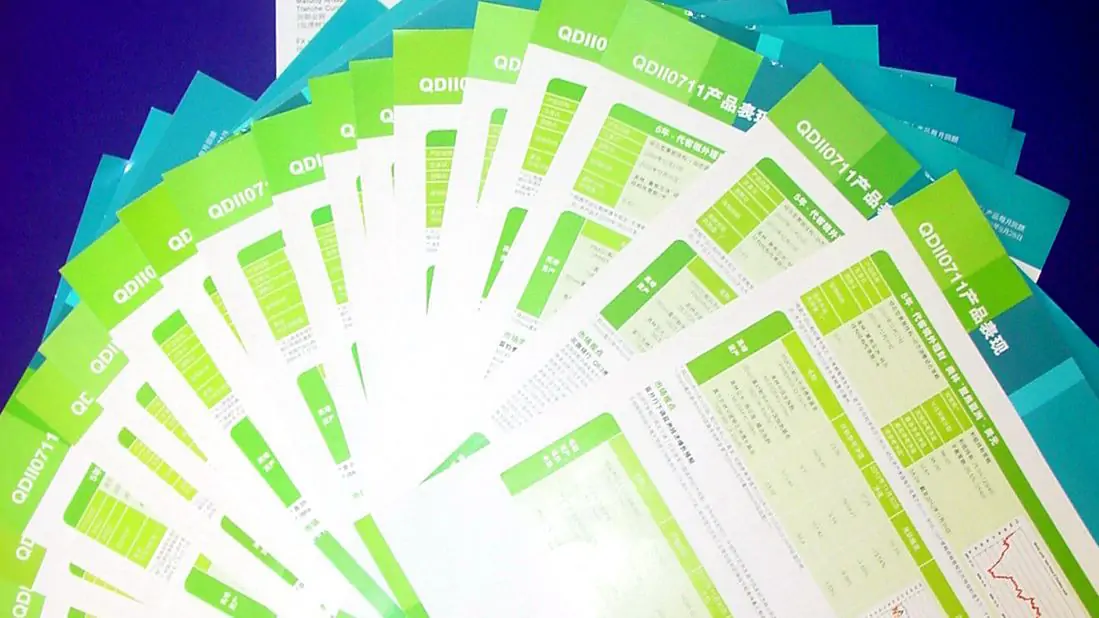

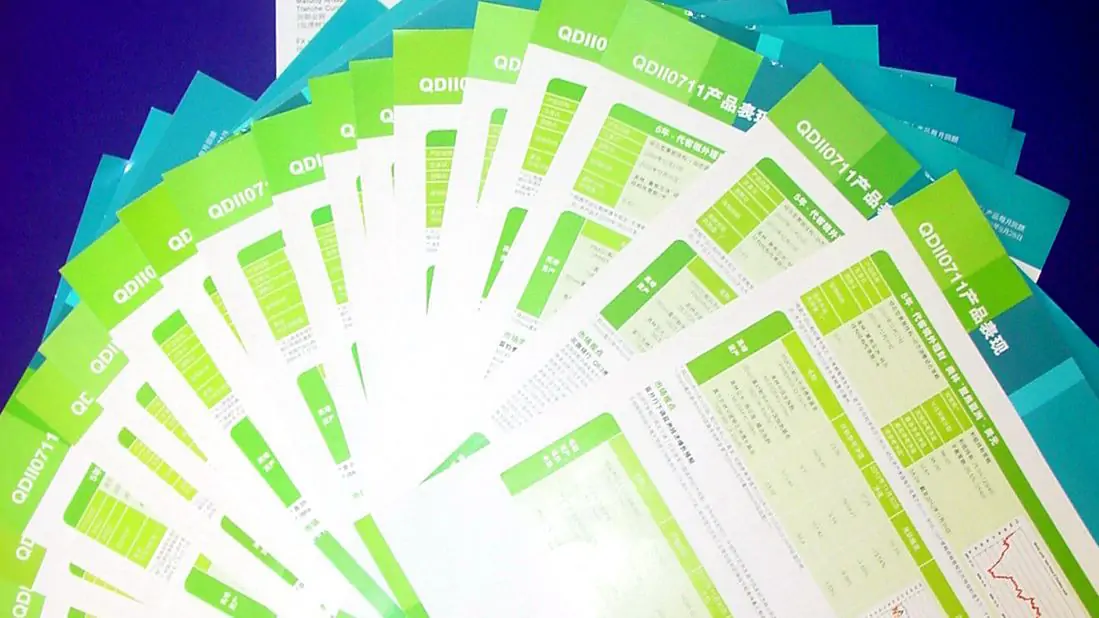

To revitalize these hard-earned assets, around 2006, I entrusted some funds to a well-known international bank for wealth management. Unfortunately, the investment results were far below expectations—several structured products suffered serious losses, especially product number QDII0711 (i.e., "Merrill Lynch Focus Asia Structured Investment No. 2 Wealth Management Plan"), which ultimately lost nearly 70%, becoming a key turning point for me to switch to independent investment.

In 2008, as the Chinese government further strengthened its regulation of cross-border capital flows, a large amount of export revenue became stuck in the overseas banking system, unable to be smoothly repatriated. Faced with the reality of millions of dollars being tied up in overseas accounts for an extended period, I was forced to shift from passive wealth management to active management, and began systematically engaging in long-term foreign exchange investment. My investment cycle is typically three to five years, focusing on fundamental drivers and macroeconomic trend judgments, rather than short-term high-frequency or scalping trading.

This fund pool not only includes my personal capital but also integrates the overseas assets of several partners engaged in export trade who also faced the problem of capital being tied up. Based on this, I also actively seek cooperation with external investors who have a long-term vision and matching risk appetite. It is important to note that I do not directly hold or manage client funds, but rather provide professional account management, strategy execution, and asset operation services by authorizing the operation of clients' trading accounts, committed to helping clients achieve steady wealth growth under strict risk control.

Foreign Exchange Manager Z-X-N's Diversified Investment Strategy System.

I. Currency Hedging Strategy: Focusing on substantial currency exchange transactions, with long-term stable returns as the core objective. This strategy uses currency swaps as the core operational vehicle, constructing a long-term investment portfolio to achieve continuous and stable returns.

II. Carry Trade Strategy: Targeting significant interest rate differences between different currency pairs, this strategy implements arbitrage operations to maximize returns. The core of the strategy lies in fully exploring and realizing the continuous profit potential brought by interest rate differentials by holding the underlying currency pair for the long term.

III. Long Terms Extremes-Based Positioning Strategy: Based on historical currency price fluctuation cycles, this strategy implements large-scale capital intervention to buy at the top or bottom when prices reach historical extreme ranges (highs or lows). By holding positions long-term and waiting for prices to return to a reasonable range or for a trend to unfold, excess returns can be realized.

IV. Crisis & News-Driven Contrarian Strategy: This strategy employs a contrarian investment framework to address extreme market conditions such as currency crises and excessive speculation in the foreign exchange market. It encompasses diverse operational models including contrarian trading strategies, trend following, and long-term position holding, leveraging the amplified profit window of market volatility to achieve significant differentiated returns.

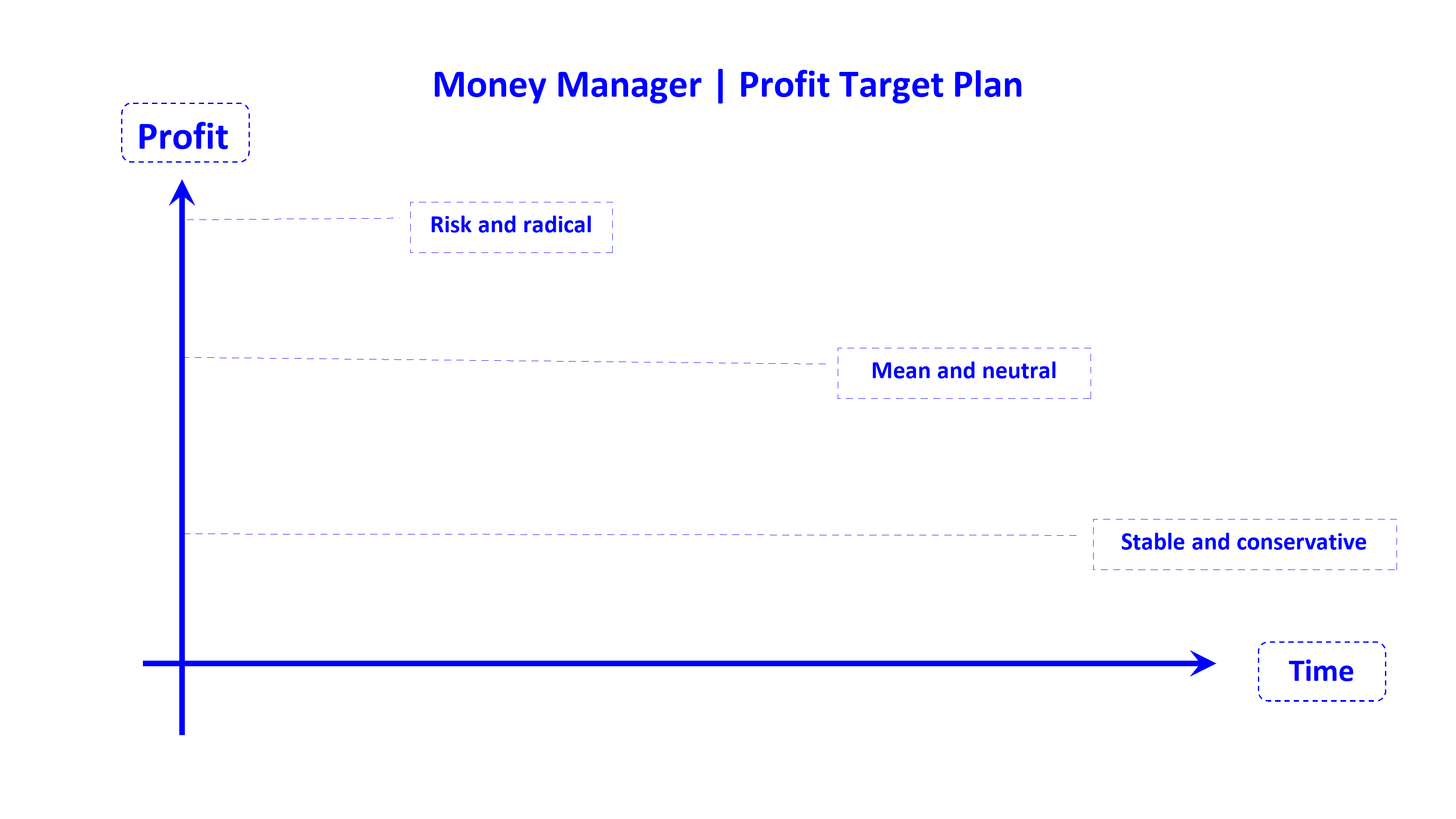

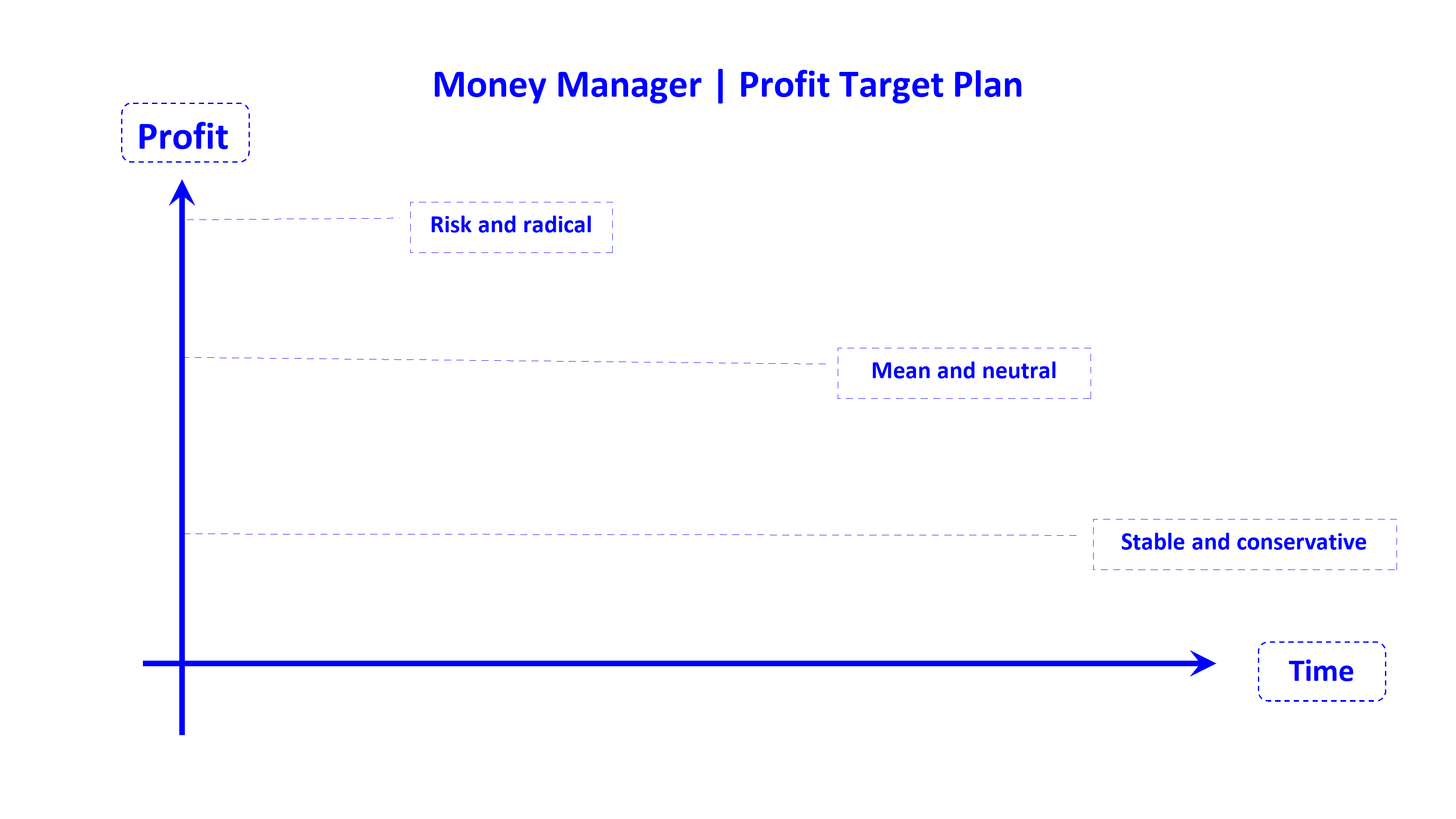

Profit and Loss Plan Explanation for Forex Manager Z-X-N

I. Profit and Loss Distribution Mechanism.

1. Profit Distribution: The forex manager is entitled to 50% of the profits. This distribution ratio is a reasonable return on the manager's professional competence and market timing ability.

2. Loss Sharing: The forex manager is responsible for 25% of the losses. This clause aims to strengthen the manager's decision-making prudence, restrain aggressive trading behavior, and reduce the risk of excessive losses.

II. Fee Collection Rules.

The forex manager only charges a performance fee and does not charge additional management fees or trading commissions. Performance Fee Calculation Rules: After deducting the current period's profit from the previous period's loss, the performance fee is calculated based on the actual profit. Example: If the first period has a 5% loss and the second period has a 25% profit, then the difference between the current period's profit and the previous period's loss (25% - 5% = 20%) will be used as the calculation base, from which the forex manager will collect the performance fee.

III. Trading Objectives and Profit Determination Method.

1. Trading Objectives: The forex manager's core trading objective is to achieve a conservative return rate, adhering to the principle of prudent trading and not pursuing short-term windfall profits.

2. Profit Determination: The final profit amount is determined comprehensively based on the market fluctuations and actual trading results for the year.

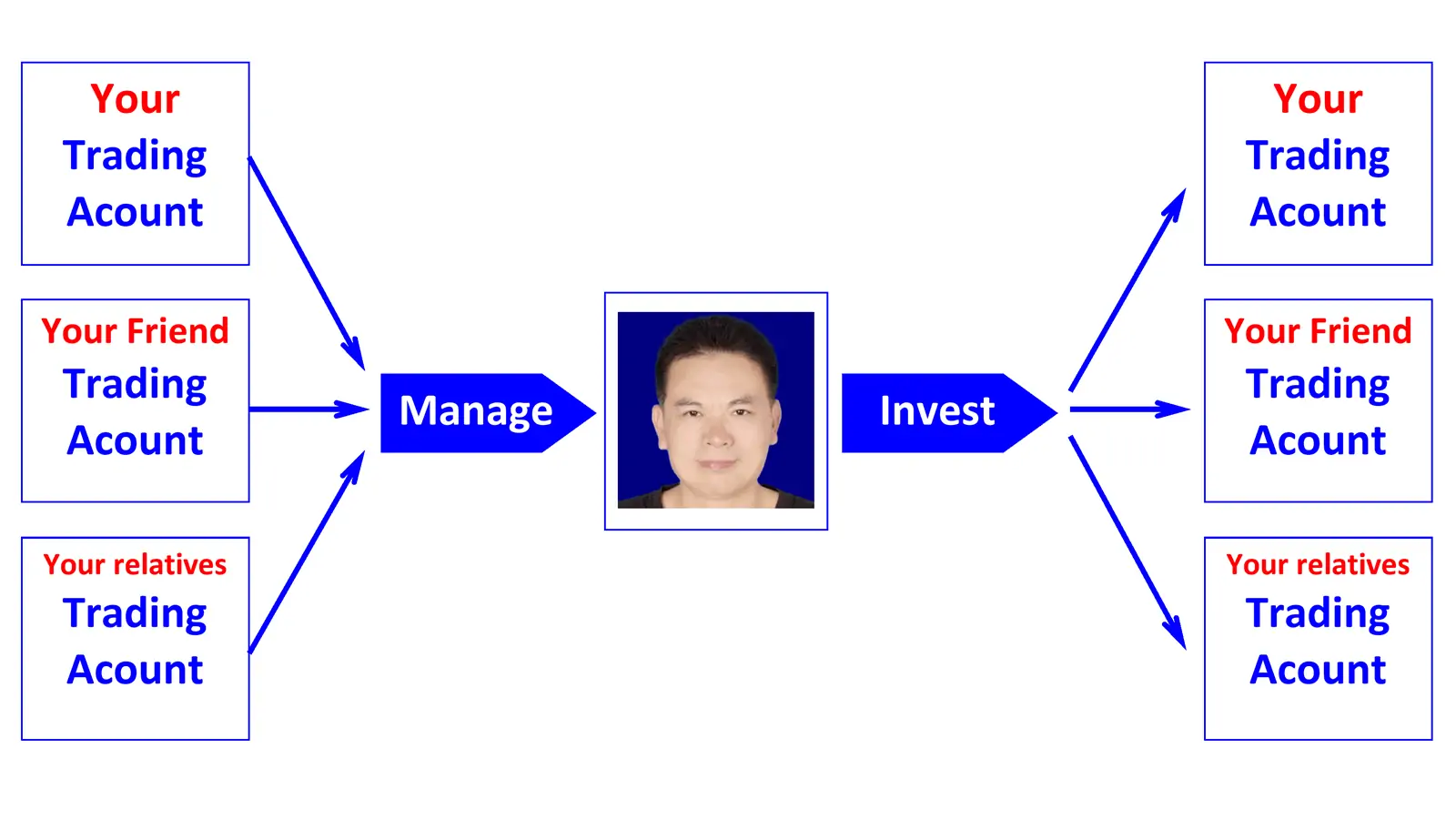

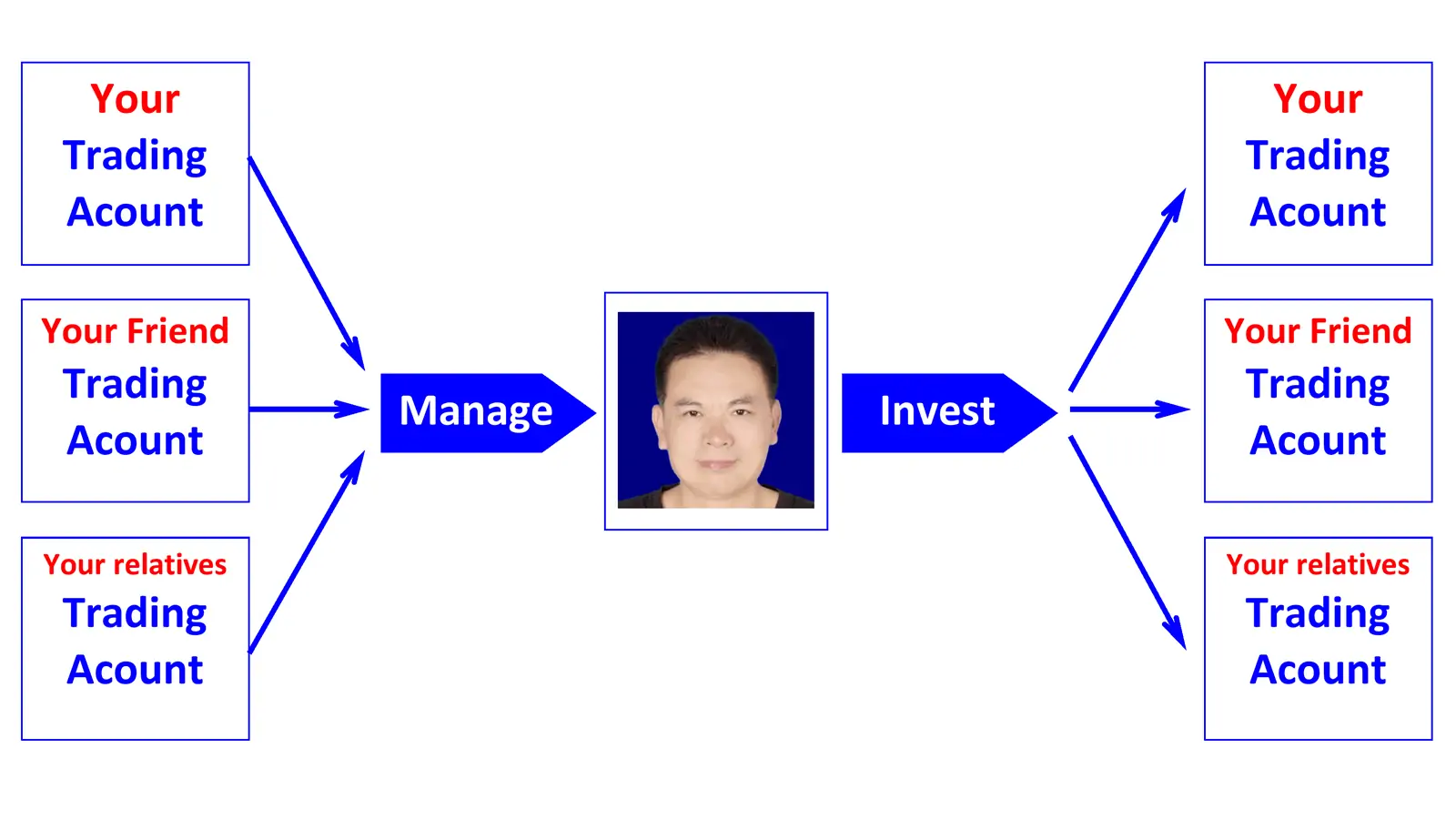

Forex Manager Z-X-N provides you with professional forex investment and trading services directly!

You directly provide your investment and trading account username and password, establishing a private direct entrustment relationship. This relationship is based on mutual trust.

Service Cooperation Model Description: After you provide your account information, I will directly conduct trading operations on your behalf. Profits will be split 50/50. If losses occur, I will bear 25% of the loss. Furthermore, you can choose or negotiate other cooperation agreement terms that conform to the principle of mutual benefit; the final decision on cooperation details rests with you.

Risk Protection Warning: Under this service model, we do not hold any of your funds; we only conduct trading operations through the account you provide, thus fundamentally avoiding the risk of fund security.

Joint Investment Trading Account Cooperation Model: You provide the funds, and I am responsible for the execution of trades, achieving professional division of labor, shared risk, and shared profits.

In this cooperation, both parties jointly open a joint trading account: you, as the investor, provide the operating capital, and I, as the trading manager, am responsible for professional investment operations. This model represents a mutually beneficial cooperative relationship established between natural persons based on full trust.

Account profit and risk arrangements are as follows: For profits, I will receive 50% as performance compensation; for losses, I will bear 25% of the losses. Specific cooperation terms can be negotiated and drafted according to your needs, and the final plan respects your decision.

During the cooperation period, all funds remain in the joint account. I only execute trading instructions and do not hold or safeguard funds, thereby completely avoiding the risk of fund security. We look forward to establishing a long-term, stable, and mutually trusting professional cooperation with you through this model.

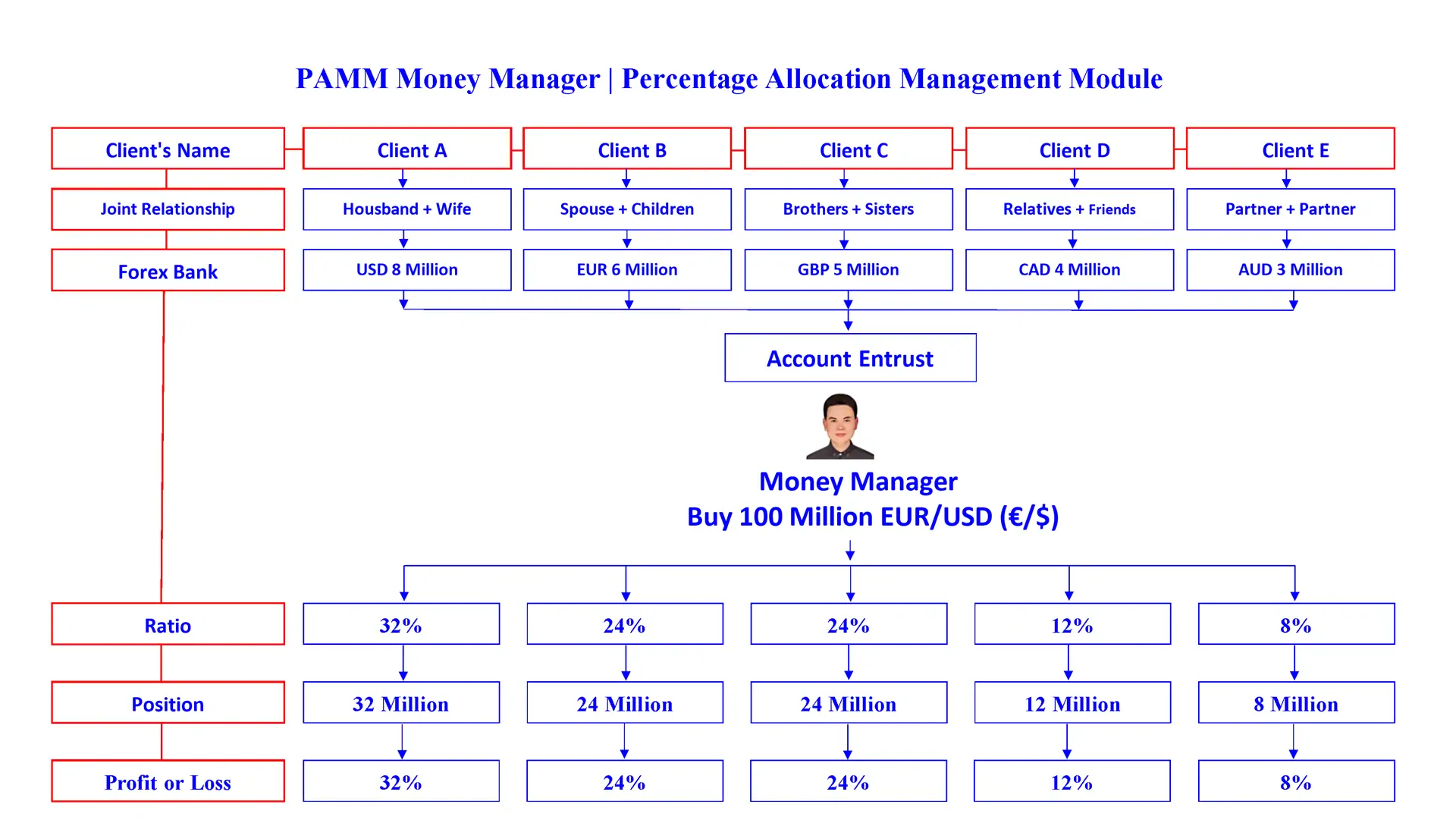

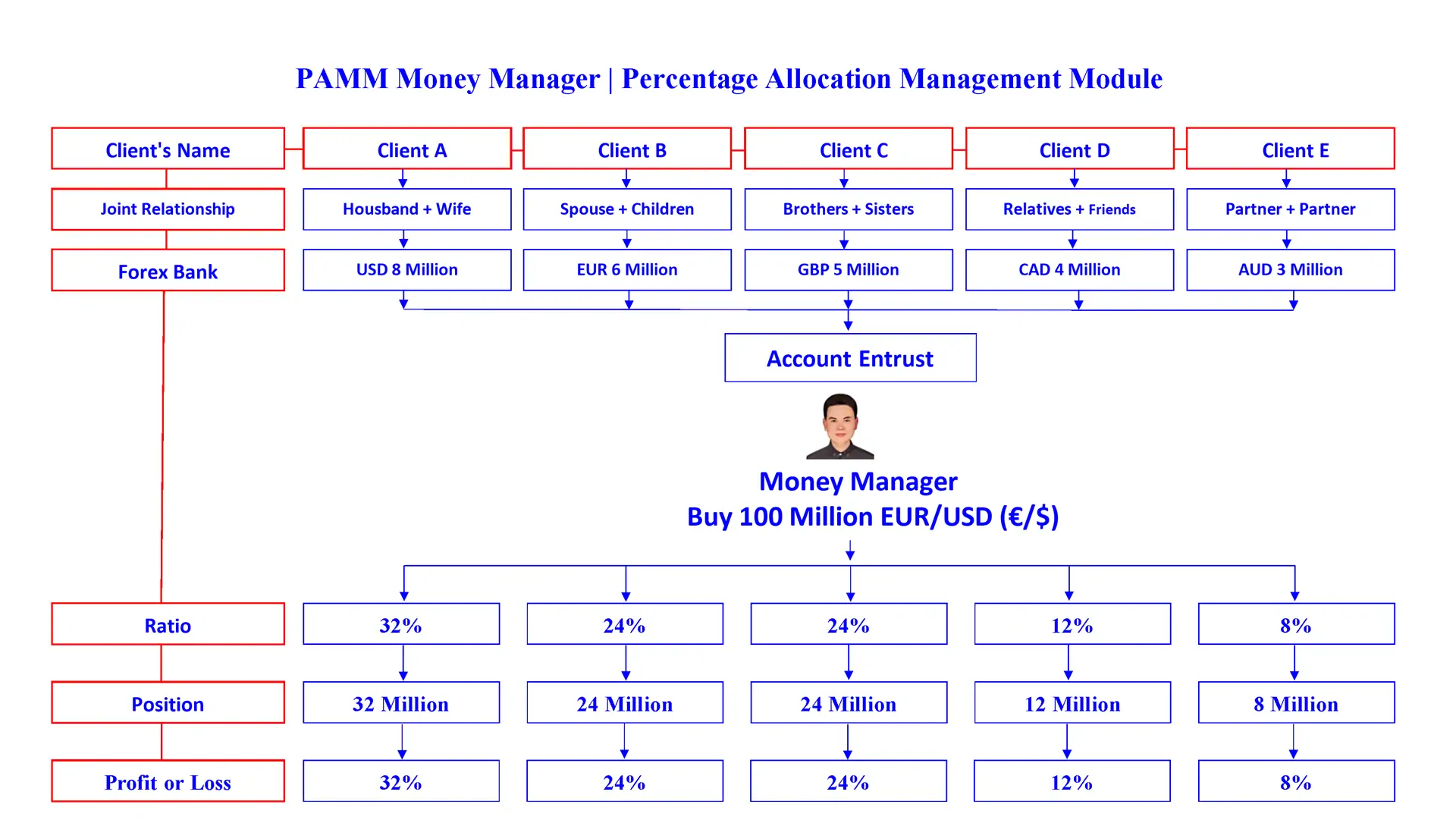

MAM, PAMM, LAMM, POA, and other account management models primarily provide professional investment and trading services for client accounts.

MAM (Multi-Account Management), PAMM (Percentage Allocation Management), LAMM (Lot Allocation Management), and POA (Power of Attorney) are all widely supported account management structures by major international forex brokers. These models allow clients to authorize professional traders to execute investment decisions on their behalf while retaining ownership of their funds. This is a mature, transparent, and regulated form of asset management.

If you entrust your account to us for investment and trading operations, the relevant cooperation terms are as follows: Profits will be split 50/50 between both parties, and this split will be included in the formal entrustment agreement issued by the forex broker. In the event of trading losses, we will bear 25% of the loss liability. This loss liability clause is beyond the scope of a standard brokerage entrustment agreement and must be clarified in a separate private cooperation agreement signed by both parties.

During this cooperation, we are only responsible for account transaction operations and will not access your account funds. This cooperation model has eliminated fund security risks from its operational mechanism.

Introduction to Account Custody Models such as MAM, PAMM, LAMM, and POA.

Clients need to entrust a forex manager to manage their trading accounts using custody models such as MAM, PAMM, LAMM, and POA. After the entrustment takes effect, the client's account will be officially included in the management system of the corresponding custody model.

Clients included in the MAM, PAMM, LAMM, and POA custody models can only log in to their account's read-only portal and have no right to execute any trading operations. The account's trading decision-making power is exercised uniformly by the entrusted forex manager.

The entrusted client has the right to terminate the account custody at any time and can withdraw their account from the MAM, PAMM, LAMM, and POA custody system managed by the forex manager. After the account withdrawal is completed, the client will regain full operational rights to their own account and can independently carry out trading-related operations.

We can undertake family fund management services through account custody models such as MAM, PAMM, LAMM, and POA.

If you intend to preserve and grow your family funds through forex investment, you must first select a trustworthy broker with compliant qualifications and open a personal trading account. After the account is opened, you can sign an agency trading agreement with us through the broker, entrusting us to conduct professional trading operations on your account; profit distribution will be automatically cleared and transferred by the trading platform system you selected.

Regarding fund security, the core logic is as follows: We only have trading operation rights for your trading account and do not directly control the account funds; at the same time, we give priority to accepting joint accounts. According to the general rules of the forex banking and brokerage industry, fund transfers are limited to the account holder and are strictly prohibited from being transferred to third parties. This rule is fundamentally different from the transfer regulations of ordinary commercial banks, ensuring fund security from a systemic perspective.

Our custody services cover all models: MAM, PAMM, LAMM, and POA. There are no restrictions on the source of custody accounts; any compliant trading platform that supports the above custody models can be seamlessly integrated for management.

Regarding the initial capital size of custody accounts, we recommend the following: Trial investment should start at no less than US$50,000; formal investment should start at no less than US$500,000.

Note: Joint accounts refer to trading accounts jointly held and owned by you and your spouse, children, relatives, etc. The core advantage of this type of account is that in the event of unforeseen circumstances, any account holder can legally and compliantly exercise their right to transfer funds, ensuring the safety and controllability of account rights.

Appendix: Over Two Decades of Practical Experience | Tens of Thousands of Original Research Articles Available for Reference.

Since shifting from foreign trade manufacturing to foreign exchange investment in 2007, I have gained a deep understanding of the operating essence of the foreign exchange market and the core logic of long-term investment through over a decade of intensive self-study, massive real-world verification, and systematic review.

Now, I am publishing tens of thousands of original research articles accumulated over more than two decades, fully presenting my decision-making logic, position management, and execution discipline under various market environments, allowing clients to objectively assess the robustness of my strategies and the consistency of long-term performance.

This knowledge base also provides a high-value learning path for beginners, helping them avoid common pitfalls, shorten trial-and-error cycles, and build rational and sustainable trading capabilities.

Foreign exchange is not a get-rich-quick scheme, but a lifelong endeavor; you don't need to ring the bell every day, just confirm annually that the river still flows to the sea.

In the two-way forex market, the core principle for traders adhering to a long-term investment strategy is to accurately grasp the major market trends, always maintain a light position size, and calmly navigate market fluctuations without being swayed by short-term profit and loss swings. These traders often view forex trading as a long-term career, some even incorporating it into their lifelong professional plan, approaching each trading decision with meticulous care rather than pursuing short-term speculative profits.

Compared to the stable orientation of long-term investment, the short-term market of forex is always accompanied by violent fluctuations, and the corresponding returns exhibit strong uncertainty. Short-term gains often involve many accidental factors; substantial profits at one time do not necessarily equate to solid trading skills, and occasional losses cannot be simply equated with a lack of trading ability. Essentially, the success or failure of short-term trading depends more on the element of luck.

In stark contrast to the uncertainty of short-term speculation, achieving long-term stable profits inevitably relies on a continuously refined and perfected trading system, and even more importantly, on the establishment of a rigorous risk control system. This involves building a strong risk defense through scientific position management and strict stop-loss and take-profit settings.

In the forex investment field, the "accumulating small profits into large gains" model—where small wins gradually accumulate into substantial profits—is far more reliable and sustainable than pursuing short-term windfalls. This also determines that the core support for long-term profitability lies in the trader's comprehensive strength, not in mere luck. Therefore, in the long-term development of the forex market, temporary periods of stagnation—whether it's a day or two of no profit or a month of lackluster returns—should not cause excessive anxiety. Traders should focus on the long term, developing trading plans with a long-term perspective to gain a foothold in the ever-changing market.

Mature forex traders only monitor both ends of the line: one end for stop-loss, one end for take-profit; they don't move until the line is reached.

In the arena of two-way forex trading, the joy of winners and the despondency of losers ultimately settle into a profound torment—the very essence of the forex trading world. No trader can escape this market-given experience. Whether it's the anxious holding of a profitable position or the agonizing struggle of accepting a loss, these are essentially unavoidable mental trials in the trading process.

The forex market never operates according to the subjective rhythm of individual traders. It won't rise instantly because of a bullish conviction, nor will it suddenly plummet because of a bearish judgment. Its movements often exhibit a circuitous and tortuous characteristic, frequently advancing a few steps only to be followed by a larger pullback. Five steps forward followed by seven steps back, or even ten steps forward followed by twelve steps back, are common occurrences. The alternation of consolidation and breakout constitutes the normal rhythm of market operation. This fluctuation pattern, independent of human will, requires traders to abandon any illusions of controlling the market and fully accept its inherent operating logic.

The forex market never belongs to any single individual. What traders truly need to clarify is their own role within the trading system. A mature trading mindset never fixates on the superficial fluctuations of the market, but rather focuses on pre-set stop-loss and take-profit levels: holding positions as long as the stop-loss line isn't hit, and patiently waiting until the take-profit level is reached. Market fluctuations at other times are essentially unrelated to the trading plan. The anxiety and impulsive trading that arise when these levels aren't reached are ultimately futile internal struggles, only interfering with objectivity and increasing the probability of trading errors.

The core essence of forex trading is not accurately predicting market movements; it is essentially a strategic game built on probability. Behind every trading decision lies a balance between win rate and risk, not an absolute prediction of market trends. True professional traders have long since incorporated profits and losses into their established trading systems and plans. They remain calm and composed when profitable, recognizing it as a natural result of strategy execution; they are unperturbed by losses, understanding it as a normal cost in a game of probability. This composure in the face of market fluctuations is the core of professional competence.

It is worth noting that when traders become elated by profits or despondent by losses, this is a dangerous signal that emotions are driving their decisions. The safest course of action at this point is to postpone placing orders, avoiding irrational decisions made under emotional control. Traders at this stage have not yet truly transcended the shackles of emotional trading and still need to hone their character through market experience. Only by maintaining a clear understanding amidst market volatility, proactively scaling back trading during periods of consolidation, and patiently resisting market uncertainties can traders gain a foothold in the ever-changing market. If taking losses in stride is a key sign of a trader's maturity, then being able to calmly accept profits is the crucial threshold for breaking through trading bottlenecks and joining the ranks of true masters. Only in this way can one break free from the mental constraints of profit fluctuations and achieve long-term sustainability in their trading career.

In the forex market, pullbacks are not alarming for long-term traders, but rather a quiet welcome.

In the forex market, participants with different trading timeframes exhibit significantly different perceptions and coping strategies regarding pullbacks. For long-term forex traders, pullbacks are not a risk to avoid, but rather something to be feared; they should actively get used to and even accept this market volatility. Compared to short-term traders' instinctive fear of pullbacks, the core advantage of long-term traders lies precisely in their deep understanding and rational utilization of the value of pullbacks.

Short-term traders fear drawdowns because their trading logic heavily relies on locking in short-term profits. They worry that floating losses from drawdowns will erode existing gains, or even wipe out profits entirely. Based on this concern, most short-term traders don't passively wait for floating losses to materialize; instead, they decisively execute stop-loss orders as soon as signs of a market pullback appear to mitigate potential risk.

In stark contrast, drawdowns are irreplaceable for long-term forex traders who practice value investing. For long-term traders already holding target currency pairs, drawdowns present rare opportunities to add to their positions. By buying at lower prices during a pullback, they can average down their overall cost basis and increase the potential profit margin for their long-term holdings. For traders who haven't yet entered a currency pair but have long-term investment plans, market pullbacks also provide ideal entry windows, allowing them to begin building positions within a relatively reasonable valuation range, laying a solid foundation for future long-term investments.

Forex investors should adopt a long-term perspective, focusing on long-term gains rather than short-term profits.

In the two-way trading ecosystem of the forex market, investors with a long-term vision can often transcend the constraints of short-term fluctuations, focusing on broader market cycles. Adhering to the investment wisdom of "playing the long game," they proactively abandon the pursuit of small, fluctuating profits and concentrate on capturing core, trend-driven profit opportunities.

Compared to these long-term value-oriented investors, short-term traders exhibit drastically different operating models. They are often deeply involved in frequent intraday trading, working tirelessly like busy office workers, yet often failing to achieve their desired profit results due to the randomness of short-term market fluctuations. Delving into the root cause, the core problem with short-term trading lies in traders' excessive focus on daily profits and losses, limiting their attention to minute fluctuations and lacking judgment and grasp of long-term market trends. This narrow-minded perspective often leads them to miss genuine profit opportunities in frequent trading games.

In fact, the profit logic of the forex market has always favored participants with a long-term vision. A truly stable profit-making trading model is essentially this long-term approach of "casting a long line to catch a big fish." Just as business owners prioritize overall annual returns over daily revenue fluctuations, mature forex investors proactively break free from the constraints of short-term profits and losses, focusing their core attention on the certain returns brought by long-term trends, achieving depth of profit through breadth of vision.

In the complex ecosystem of two-way forex trading, any attempt to forcibly lead others to profit is essentially an overstepping of boundaries and an act of "changing someone else's fate."

It's crucial to understand that every investment decision carries its own causal entanglements. When a trader actively guarantees someone else's profits, they are essentially assuming all the unknowns and risks of that person's investment journey. This weighty burden of cause and effect is never easily borne by outsiders.

Experienced forex traders who truly understand the darker side of human nature and the laws of the market often adhere to a clear-headed self-discipline: they don't actively guide others into the market, they don't accept others' financial management commissions, and they don't make any specific investment recommendations. Even requests for help from close friends and family are politely declined in an appropriate manner. This isn't an unsympathetic excuse, but a profound insight into human nature and the market—in most people's eyes, when a recommender demonstrates investment prowess, profits become a natural expectation; however, once market fluctuations lead to losses, all responsibility will undoubtedly be attributed to the recommender. Those seemingly unbreakable kinship and friendships are often incredibly fragile in the face of the ups and downs of capital; a collapse of trust is enough to shatter a once harmonious relationship.

In fact, in the realm of two-way forex trading, mature traders should adhere to the principle of "teaching a man to fish rather than fishing for him." Teaching others the logic of investment, methods of risk control, and a framework for market understanding, helping them build an independent judgment system, is far more prudent than directly planning their trading path. This is by no means cold indifference, but a rational clarity tempered by the market: clearly knowing the boundaries of one's own abilities, understanding that one cannot control all market variables, and being aware that one cannot bear the unrealistic profit expectations of others. Only by maintaining this sense of boundaries can one safeguard one's own trading rhythm while also preserving the most precious emotional connections with others. This is the rarest clarity and self-control in the forex investment arena.

In the realm of two-way trading in forex investment, traders who truly achieve consistent profits often disdain to explain their trading principles to others.

This phenomenon is not an isolated case. In the traditional cognitive dimension of real life, true wisdom is never easily imparted to others—for intelligent people, principles are a consensus that needs no further explanation; for confused people, cognitive barriers prevent them from grasping the core of principles, making instruction futile. If a wise person is willing to proactively offer guidance, it means they see potential for growth in you, recognize you as being on the verge of wisdom and confusion, and hope to help you break through cognitive barriers and join the ranks of the wise through a few words of inspiration. This initiative is always imbued with benevolent intentions of salvation, not malicious intent to harm. Just as parents' earnest teachings to their children stem from deep-seated expectations, hoping their children will shed their immaturity and grow into independent adults through the influence of reason.

Returning to the two-way trading scenario of forex investment, truly profitable traders don't need lecturing. This is fundamentally consistent with the logic of wise people in reality: intelligent traders have already built a complete trading system based on their own understanding; external principles are merely redundant information to them. Traders lacking sufficient understanding, however, cannot grasp the deep core of trading logic, nor can they empathize with the wisdom of decision-making amidst market fluctuations; lecturing ultimately fails to reach the core. More importantly, forex trading itself is a systematic project integrating knowledge reserves, industry common sense, technical analysis, practical experience, and trading psychology. The complexity of this system far exceeds imagination; it cannot be fully outlined in a few words, much less explained in a few days. It requires traders to immerse themselves in the process with long-term patience, constantly learning, exploring, and repeatedly testing in real-world scenarios, learning through trial and error, and ultimately internalizing external knowledge into their own trading intuition and decision-making abilities. This growth process is highly individualized; even if outsiders want to help, they will find it difficult to find a starting point. Even blood relatives cannot do it for you—just as you cannot force-feed an adult, it violates the objective laws of individual growth and contradicts basic common sense.

In the context of two-way forex trading, the hidden risks of gold investment often lie in the relationship between trading volume and transaction costs. This is a point that forex traders need to carefully recognize.

Many traders hold a misconception, assuming the gold market is the most liquid trading market globally, believing that its daily trading volume is so large that even single trades of dozens or even hundreds of lots can be completed smoothly. However, this perception deviates significantly from the actual market reality.

The scarcity of trading volume in the gold market is directly evidenced by transaction costs and market reactions. Industry consensus suggests that a trading volume of several thousand lots within a minute in gold trading is enough to attract industry attention, highlighting its limited trading volume. Specifically, regarding transaction costs, the spread cost for a single lot of gold trading is typically between ten and twenty dollars. As the number of lots traded increases, the cost pressure rises further, and slippage risk intensifies simultaneously—slippage begins to appear when a single trade reaches two or three lots, or even three to five lots; if the number of lots increases to 10, the overall transaction cost often exceeds thirty dollars, and in extreme cases, can even reach forty dollars, which undoubtedly erodes trading profits significantly.

From an authoritative data perspective, the average daily trading volume in the gold market is far below traders' expectations. Taking the CME Group in the US, a core global exchange, as an example, its average daily trading volume for gold futures is only around 100,000 lots. Distributed across each trading session, the tradable volume per unit of time is even more limited. This characteristic is particularly pronounced during the quiet morning trading hours. At this time, a single order of ten lots can significantly impact gold prices, triggering short-term fluctuations; a single order of dozens of lots can have an even greater impact on market price trends, exacerbating market uncertainty.

More importantly, large transactions in the gold market face the dual challenges of difficulty in execution and the risk of offsetting positions. When a single transaction reaches 30 lots, even without slippage, some trading platforms may adopt a position-matching model with investors, indirectly increasing trading risk. Attempting to place a single order of hundreds of lots is essentially impractical in the current liquidity environment of the gold market; either the transaction cannot be completed, or the actual transaction price deviates from the displayed price by several dollars or even tens of dollars, leading to unexpected trading losses.

In summary, within the two-way trading system of the forex market, the inherent scarcity of trading volume in the gold market directly leads to high transaction costs (including commissions, spreads, etc.). Coupled with slippage risk, execution barriers, and potential position-matching risks associated with large transactions, gold investment is not an ideal trading choice. Traders need to rationally mitigate investment risks in this area based on a thorough understanding of the market's nature.

In the two-way trading scenario of forex investment, traders should fully recognize and value the inherent advantages of forex investment compared to forex futures investment.

Forex futures trading has a unique rollover mechanism. During non-rollover periods, the trading behavior of both buyers and sellers in the market can maintain a relatively stable operation. However, once the rollover period begins, the situation changes significantly. After closing out positions, investors who have incurred losses often find themselves in a dilemma of being unwilling or afraid to open new positions. This phenomenon profoundly reflects the dominant role of psychological principles and human nature in trading behavior, and also determines that forex futures trading is more of a short-term trading activity, making it difficult to be a suitable investment category for long-term investment.

This pattern is clearly demonstrated by actual market examples: when long positions are about to roll over to the next contract month, if the market happens to experience a one-sided downward trend, investors who originally held long positions are likely to abandon their long strategy and choose to exit and observe; conversely, when short positions enter the contract rollover period, if the market experiences a one-sided upward trend, short sellers usually also terminate their short positions and enter a temporary state of observation and stagnation. It is worth noting that forex spot trading has gradually become a sunset industry and a niche field in the current market environment, and forex futures are an even smaller niche within a niche. Constrained by both market trends and their own trading rules, some forex futures investors are forced to exit and re-enter the market when rolling over to the next contract. However, if their trading direction contradicts the market trend, they instinctively choose to stop trading. This passive decision-making directly weakens the market's self-regulating forces.

Some might argue that participating in forward forex trading could circumvent these problems. However, this idea is difficult to implement in the actual market. From a trading mechanism perspective, forex futures trading is essentially a counterparty trading model. Currently, the supply of forward positions is extremely scarce. Even if investors are willing to participate in forward forex trading, they struggle to find matching counterparties, making it impossible to construct forward contracts. Considering these multiple factors, the space for forex futures market survival is shrinking, and its gradual exit from the market is becoming increasingly clear. The moment of its final exit may not be far off.

In the forex market with its two-way trading mechanism, strategy selection often involves profound contradictions: chasing breakouts carries the fear of pullbacks; waiting for pullbacks, however, is unbearable during consolidation.

In reality, traders must make a clear choice between these two options—if they decide to capture breakouts, they should accept the risk of price pullbacks; if they choose to position themselves during pullbacks, they need the patience to handle market fluctuations. No strategy is perfect; the real risk lies not in the strategy's inherent flaws, but in the missed market opportunities caused by deliberately avoiding these flaws.

The essence of an investment strategy lies in its alignment with the trader's personal style. Different methods have varying requirements in terms of psychology, time, and risk tolerance. Only by choosing a strategy that suits one's own characteristics can it be consistently executed and effective. In other words, long-term investors should naturally accept pullbacks when building positions; with a vision spanning years, why fear months of sideways trading? Short-term traders are better suited to breakout strategies, holding positions for no more than a few tens of minutes, supplemented by strict stop-loss orders. They don't need to be fixated on even the slightest drawdown. Often, what hinders trading isn't market volatility, but rather the investor's deep-seated obsession with "not losing money at all."

In the two-way trading market of forex investment, the trading behavior of traders with different capital sizes differs significantly in nature.

For forex investors with small capital, their enthusiasm for short-term high-frequency trading, seemingly professional investment operations, is actually more like a game with entertainment elements. Conversely, the low-position, long-term trading strategies adopted by large-capital forex investors, while seemingly lacking the excitement of high-frequency trading and resembling casual entertainment, actually contain rigorous planning and strategy, and are essentially genuine investment activities.

In the foreign exchange and gold trading markets, the behavior of many small-capital investors is particularly noteworthy. Many of them appear to be investing, but in reality, their actions bear many similarities to gambling. These investors generally have relatively small capital, mostly ranging from a few thousand to tens of thousands of US dollars. However, in stark contrast, they often use extremely high leverage in their trading. Currently, leverage of 500x or 1000x is quite common in the market, and some trading platforms even offer leverage as high as 2000x. Such high leverage ratios undoubtedly amplify the risks of trading to the extreme.

A deeper examination of the trading mentality of small-capital investors reveals that the core driving force behind their participation is the desire for "get rich quick." They generally harbor unrealistic profit expectations; many hope to achieve a 10%-20% return in a month of trading, or even aspire to double their capital. Such a mentality and expectations deviate from the essence of investment and are not true investment behavior. It's important to understand that high returns inevitably come with high risks. When investors blindly pursue monthly returns of 10%-100%, they are essentially facing an equal or even higher risk of loss. In extreme cases, not only could they lose 10%-100% in a single month, but they could also lose everything, wiping out their entire capital.

From the perspective of the trading environment, the high leverage tools and high position limits offered by forex trading platforms can easily lead small-capital investors lacking risk control skills into a state of disarray. This feeling of being out of control is very similar to the mentality of wanting to increase bets after losing money in a casino. Many investors, after incurring losses, not only fail to cut their losses and exit the market in time, but also further increase their investment in their eagerness to recoup their losses, ultimately leading to ever-expanding losses and a vicious cycle.

For small-capital forex investors, it is not recommended to equate forex trading with traditional investment activities. Instead, they should rationally view it as a form of entertainment, like playing a game, simply enjoying the excitement that trading brings. At the same time, it is even more important to establish a rational understanding that "trading is consumption" and regard the funds invested in foreign exchange trading as consumption costs paid to obtain emotional value and enjoy the thrill. One should not have too high expectations for the recovery of principal and profits. Only in this way can one maintain a peaceful mindset during the trading process and avoid falling into risk traps due to excessive pursuit of returns.

In forex trading, returns, risk, and liquidity are always in conflict. High liquidity means potentially higher profits but also higher losses; low liquidity means lower profits but also lower losses.

In the two-way trading scenario of forex trading, there is always an inherent tension between returns, risk, and liquidity. This tension determines that all three cannot simultaneously achieve their optimal state. There is no perfect currency pair in the forex market that offers high returns, low risk, and ample liquidity. This core logic constitutes the fundamental understanding of forex trading; any trading strategy that deviates from this logic may harbor hidden risks.

From the perspective of market essence, the forex market itself possesses high liquidity, theoretically allowing investors to complete buy and sell operations at any time. However, this characteristic is not consistently maintained under all trading strategies. Especially in short-term trading, employing a strategy of adding to positions against the trend with heavy leverage, and continuing to add to positions even when the market shows floating losses, weakens actual liquidity due to the uncertainty of when the market will reverse. In this case, investors hold positions but cannot realize them at a reasonable price, thus negating the market's inherent liquidity advantage. The core logic of this trading strategy is to exchange high risk for high returns. While short-term luck might bring temporary profits, long-term implementation is extremely dangerous. A single misjudgment of the market can wipe out all previous profits, leading to a passive situation of "losing all past gains in one fell swoop."

It is worth noting that forex investment should not use return indicators as the sole basis for decision-making. Falling into the trap of simply pursuing high returns, such as setting extreme goals like "doubling monthly returns," often forces investors to continuously increase their risk exposure, ultimately leading to a high probability of account liquidation, and all previously accumulated profits will be lost. This phenomenon further confirms the balance principle of return, risk, and liquidity in forex investment. Pursuing returns without considering risk control and liquidity is ultimately unsustainable in the long run.

In the field of two-way foreign exchange trading, the security of funds varies significantly depending on the scale of the transaction when traders choose to open accounts under offshore regulatory systems.

For trading scenarios with smaller amounts of capital, a relatively stable and secure state can usually be maintained. However, as the scale of funds expands to a certain level, the uncertainty of fund security will increase significantly due to factors such as the limited constraints of offshore regulatory systems and the difficulty in coordinating cross-border fund supervision. Potential risks are difficult to predict.

With the increasing sophistication and stringency of global financial regulatory systems, leverage restrictions on two-way foreign exchange trading have become a common regulatory direction in major regulatory regions. Different regions have set differentiated leverage ceiling standards based on their own financial market positioning and risk control objectives. The US market currently operates on a maximum leverage ratio of 50x, further reduced to 33x or 20x for some higher-risk trading instruments. In contrast, major regulatory jurisdictions like the UK have a uniform maximum leverage limit of 30x, and have developed specific leverage grading standards based on the liquidity and volatility differences of various trading instruments, forming a multi-tiered leverage regulatory system.

It is worth noting that in the forex two-way trading market, trading accounts offering leverage ratios of 100x, 200x, or even higher are often opened by institutions holding offshore licenses. The regulatory effectiveness of these offshore licenses is generally limited, often lacking the strict constraints and risk compensation mechanisms of mainstream regulatory systems. In the event of disputes over funds or platform violations, investors typically find it difficult to obtain effective regulatory intervention and redress. Especially for forex trading novices and those lacking industry experience, the account opening process often involves misconceptions about regulation. The accounts they open may not truly belong to the compliant systems of internationally renowned regulatory regions. Even if a platform claims to hold relevant regulatory licenses, these licenses often have no substantial connection to the actual custody of investor funds or transaction supervision. This means that such investors' trading funds are never 100% secure, and are constantly exposed to various risks arising from regulatory gaps.

Finding new platforms in an upward cycle has become an indispensable risk management tool in forex two-way trading.

In the forex two-way trading field, investors must first establish a core understanding: no forex trading platform can escape the natural cycle of industry development. Its life cycle often follows an evolutionary trajectory of rise, expansion, peak, and decline, much like the changing of dynasties. Therefore, it is essential to anticipate platform iterations and replacements; this is a fundamental prerequisite for ensuring investment security.

In the early stages of platform development, when a new platform enters the competitive market, it often adopts a diversified and aggressive expansion strategy to quickly break through and seize market share. At this stage, platforms typically increase brand promotion efforts, enhancing exposure through frequent advertising and sponsorship of events or industry activities. Simultaneously, they offer highly attractive incentives to agents and end customers—such as spreads as low as the industry average and higher-than-standard commission rates. Leveraging a superior trading environment and generous welfare policies, they accumulate market reputation, thereby rapidly accumulating customer resources and expanding their business scale.

However, once a platform successfully captures a sufficient market share and enters its peak development period, its operating logic undergoes a fundamental shift, with profit-oriented strategies replacing the initial expansion-oriented approach. To improve profitability and reduce operating costs, platforms often gradually tighten previous preferential policies, leading to a marginal deterioration of the trading environment and the gradual erosion of past welfare advantages. Meanwhile, with the continuous expansion of the customer base, the platform faces significantly increased management pressure in areas such as customer service and transaction risk control. The probability of various negative issues also rises accordingly, with negative news such as slippage, delayed withdrawals, and slow customer service response easily gaining exposure. The spread of negative public opinion not only increases the platform's crisis management costs but also erodes customer trust, leading to decreased customer referrals, continuous customer attrition, and ultimately, a decline in platform revenue, marking the beginning of its decline.

It is worth emphasizing that the universality of platform cycles means that there are no eternally superior trading platforms. What investors can do is select relatively suitable partners at specific stages of a platform's life cycle. When a platform's operating conditions undergo substantial changes, the platform replacement process must be initiated promptly. The core logic of this decision is that when a platform's revenue continues to shrink, its operational stability will significantly decrease, and potential operational risks such as cash flow risks and compliance risks will increase significantly, subsequently impacting the trading process and drastically amplifying the counterparty risk faced by investors. Therefore, to effectively avoid such cascading risks, proactively seeking new platforms in an upward cycle becomes an indispensable risk management tool in forex two-way trading.

At the level of constructing trading strategies, investors need to abandon the one-sided perception of "extremely compressing transaction costs" and avoid building trading strategies on an overly sensitive basis for transaction costs. It should be understood that the ultra-low spreads and other incentives offered by some platforms are essentially temporary subsidies during their early development phase and are unsustainable in the long run. If a trading strategy relies excessively on such short-term cost advantages, it will instantly lose its adaptability once the platform adjusts its policies and can no longer provide these incentives, leading to trading losses. From a long-term cooperation perspective, investors need to cultivate a "win-win" understanding of platform cooperation, ensuring a balance between their own trading profits and the platform's reasonable revenue—only when the platform can achieve sustainable profitability can the stability of the trading environment and the continuity of services be guaranteed, and only then can investors' long-term profit goals be effectively supported.

Forex traders should avoid becoming a passive party in a betting structure.

In the two-way trading mechanism of the foreign exchange market, although gold is often considered a highly liquid asset, its daily trading volume is typically between $100 billion and $200 billion, still lagging behind major currency pairs like the Euro/USD.

This volume, during most trading sessions, is closer to that of cross-currency pairs like the Euro/British Pound. Investors can obtain firsthand, objective statistics by consulting data released by authoritative institutions such as the World Gold Council, thus gaining a clearer understanding of the true liquidity of the gold market.

Precisely because the overall liquidity of the gold market is relatively limited, while the number of global investors participating is extremely large, the aggregation and hedging of a large number of orders objectively provides trading platforms with room for speculative operations. Many platforms, especially offshore or less regulated institutions, do not actually send all orders to the international market, but rather manage risk through internal hedging or counterparty trading with clients. Once an investor gains huge profits due to market volatility, especially when the profit exceeds the platform's own risk tolerance and capital reserves, the platform may be unable to repay its debts. At this point, restricting withdrawals, delaying processing, or even defaulting on payments becomes their most direct, and often only, option.

Therefore, understanding the true nature of gold liquidity not only helps investors assess market characteristics more rationally but also warns them against platforms that lure investors with high leverage and low spreads while actually operating on a gambling model. In the world of two-way trading, apparent liquidity often differs from actual payment capacity, and only by relying on real data and prudent selection can one avoid becoming a passive party in a gambling structure.

In the evolving global financial landscape, the retail forex trading industry has quietly lost its former glory and is gradually sliding towards the edge of a sunset industry.

With stricter regulations, increased market transparency, and a shift in mainstream investor interests, this sector, which once attracted countless retail investors with its promise of "high leverage and quick returns," is now facing multiple predicaments: user attrition, a drying up of profit models, and a collapse in public trust. Against this backdrop, forex industry rating agencies, which should have played an independent supervisory role, have also succumbed to the erosion of profit-driven logic. To maintain their own survival and profits, many so-called "authoritative rating platforms" have long since deviated from their original intention of objectivity and neutrality, becoming profit-seekers in another link of the industry chain.

These rating providers often employ a double-harvesting strategy: on the one hand, by creating anxiety, exaggerating returns, or exaggerating risks, they induce inexperienced small retail investors to click on advertisements and register with partner brokers, thereby obtaining high commissions; on the other hand, they use their power to pressure smaller brokers with weak financial strength and limited brand influence, using "negative review exposure" or "ranking downgrades" as leverage to force them to pay "protection fees" or purchase promotional services. This two-way arbitrage ecosystem has essentially evolved into a hidden "double-cross" game. When the rating system itself becomes a commodity, fairness becomes the first value sacrificed. Over time, the entire industry falls into a vicious cycle of trust deficit—truly high-quality services struggle to stand out, while inferior platforms can manipulate public opinion with money, severely distorting market signals and making reputation reconstruction virtually impossible.

For newcomers to the forex market and investors lacking experience in platform evaluation, it is especially important to be wary of the misleading nature of superficial information. Many negative reviews don't disappear; they are carefully filtered, suppressed, or sunk into the depths of information, making them completely undetectable to ordinary users. Those seemingly quantifiable and intuitive star ratings are often based on vague or even manipulable standards, lacking both transparent methodology and third-party audit verification, rendering their reference value negligible. Real risks often lurk beneath the surface of overwhelmingly positive reviews. Therefore, instead of blindly trusting the clamor of online reviews, it's better to return to the fundamentals: carefully verify the authority of the platform's regulatory body, the independence of its fund custody mechanism, and the stability of its historical withdrawal records. Only by seeing through the superficial appearances can one safeguard the safety of their assets amidst the chaos.

In the two-way forex market, high-frequency trading is often a typical characteristic of traders entering the market in their early stages, and this stage is also considered the introductory phase of forex investment.

For beginners in the forex market, trading behavior is often characterized by blindness and randomness, with a consistently high frequency of trades per day, ranging from a dozen or so trades to twenty or thirty, and in extreme cases, even up to a hundred. Such trading often lacks clear logical support, relying entirely on subjective feelings to drive decision-making. There are no established trading rules or operational methods, let alone a systematic trading system to rely on. Even the key judgments of market tops and bottoms are based solely on intuition, with each trade operating in a disorderly state without any systemic constraints.

In stark contrast to the high-frequency trading of novices, mature and experienced traders adhere to a "less is more" trading philosophy, and their trading rhythm is more steady and restrained. Even seasoned forex traders specializing in short-term forex pair trading typically only make two or three trades per day, often adhering to a patient waiting principle and only trading once every few days. The core advantage of experienced traders lies in their well-developed and tailored trading system, with each trade strictly following its rules: they only enter a trade when the market price reaches predetermined support or resistance levels, combined with a comprehensive assessment of dynamic changes in market sentiment; otherwise, they maintain a wait-and-see attitude, cautiously testing the waters with small, trial trades, never easily disrupting their established trading rhythm.

It's important to emphasize that in the forex market, there are no scenarios where high-quality trading opportunities are available every day, let alone a large number of actionable opportunities emerging daily. For novice traders executing dozens or even hundreds of trades a day, this high-frequency and disorganized trading pattern is often the main cause of account blowouts. Furthermore, beginners should proactively avoid trading instruments with abnormally volatile price swings, such as gold and Bitcoin. Even if the overall market direction is accurately predicted, improper entry points can easily lead to margin calls due to short-term volatility, ultimately resulting in investment losses.

In the two-way trading mechanism of forex investment, frequent trading, while seemingly active and aggressive, actually harbors fatal hidden dangers—its most dangerous problem lies in the asymmetrical profit and loss structure of "small wins and big losses."

Traders often accumulate false confidence through multiple small profits, only to suffer a devastating drawdown due to a single misjudgment of the trend. This loss is not just ordinary floating losses, but a systemic risk that can wipe out all previous gains and even jeopardize the principal. The root cause is that high-frequency trading inherently weakens the rigor of strategies and the effectiveness of risk control, turning trading into an emotionally driven random game.

Leverage, as a double-edged sword in the forex market, while necessary to amplify returns, also magnifies potential losses many times over. In the current market, many platforms, self-media outlets, and even so-called "mentors" are keen to promote the myth of high-leverage profits, inducing investors to bet on highly volatile assets like gold with leverage of hundreds of times. However, once the directional judgment is wrong, especially when liquidity is insufficient or the market experiences sharp gaps, accounts can be wiped out instantly. While gold possesses a safe-haven aura and exhibits rapid short-term volatility, making it highly attractive, its price movements are influenced by a complex interplay of multiple macroeconomic variables, making it extremely difficult to predict accurately. Many investors become complacent when they profit, yet refuse to acknowledge their trend errors in the early stages of losses, stubbornly holding onto their positions, ultimately turning manageable small losses into irrecoverable massive losses—a typical tragedy born from the intertwining of human weaknesses and the cruelty of the market.

Therefore, seasoned traders, tempered by market experience, often choose to simplify their approach, focusing on a single major currency pair, such as EUR/USD. This pair offers ample liquidity, relatively stable price movements, and a clear technical structure, making it easier to identify trends and set reasonable stop-loss orders. Assuming a correct directional judgment, investors are more likely to steadily build positions at low levels and calmly take profits at high levels. Even if a misjudgment occurs, they can quickly exit the market, avoiding the predicament common in commodities like gold where "the direction is correct, but the account is wiped out due to price levels or slippage." This focus is not conservatism, but a clear understanding of risk boundaries and one's own circle of competence.

At the same time, investors need to be especially wary of the "signal-calling culture" prevalent on social media. Various groups and comment sections commonly exhibit selective disclosure, only showing screenshots of doubled profits while concealing consecutive stop-losses; using inflammatory language such as "easy money," "guaranteed wins," and "expert guidance" to package high-risk operations, even fabricating historical performance and claiming that a certain "mentor's" account has multiplied hundreds or thousands of times. Such promotions are highly deceptive and are often marketing traps to attract traffic and monetize. Real followers often find that the so-called "miracle trades" are either delayed or simply impossible to replicate, ultimately becoming tools for platforms or agents to collect commissions. The true path to trading never relies on others to do it for you, but rather on cultivating independent judgment, strict discipline, and a deep respect for the market. Only in this way can one achieve long-term success in the two-way game of the forex market, rather than becoming fuel for someone else's feast.

In the two-way trading realm of forex investment, the notion that "trading is simple" always comes with specific preconditions and is not a universally applicable conclusion.

If a novice investor casually claims that trading is simple, it reflects an insufficient understanding of market complexity, trading logic, and the interconnectedness of risks. Such statements often lack insight into the overall market and are not supported by practical experience, thus lacking sufficient credibility.

Conversely, when traders have dedicated two decades to in-depth research, persistent practice, and repeated refinement, experiencing the entire trading process from strategy construction and market analysis to position management and risk control, and after gaining a deep understanding of market dynamics and developing a mature and stable trading system, their talk of "simple" trading transcends the initial superficial understanding. This "simplicity" is a clarity achieved through streamlining, a composure after mastering complexity, and a concise expression of a precise grasp of the essence of trading. It is not only tangible but also possesses credibility that withstands market scrutiny.

Foreign exchange trading does not rely on secret "insider information" but rather tests the depth of a trader's understanding of the dynamics of currency pairs.

In the two-way trading context of foreign exchange investment, investors who wish to truly establish themselves in the global financial market must first deeply understand the fundamental differences in the underlying logic between the stock market and the foreign exchange market. The stock market has long suffered from the structural problem of information asymmetry. Insider information, manipulation, and misleading public opinion intertwine to form an invisible web. Mystified narratives such as "institutional buying" and "major positive news" are often nothing more than carefully designed tools for market manipulators and gray-market intermediaries to harvest profits. They habitually use inflammatory rhetoric like "emergency entry" and "accuracy rate over 90%" to precisely exploit retail investors' herd mentality and get-rich-quick fantasies, creating a false sense of prosperity while quietly distributing shares. Ordinary retail investors, at the very end of the information chain, often follow the crowd at emotional highs, unaware that major players have already laid out their exit routes, waiting for them to buy before quickly dumping their shares and leaving countless investors with nothing.

Especially now, with the increasing use of quantitative trading systems in the stock market, high-frequency algorithms, leveraging their millisecond-level response and big data advantages, specifically target retail investors who are slow to react and lack system protection, implementing a "micro-profit accumulation" harvest. In this environment, a staggering 99.9% of small investors with capital under 10,000 yuan suffered losses, demonstrating that the stock market has become, for ordinary individuals, a systemically disadvantageous game—ostensibly investment, but in reality, a systemic informational trap.

In contrast, the foreign exchange market presents a completely different ecosystem. As the world's largest and most decentralized financial arena, its daily trading volume of trillions of dollars means that no single institution, sovereign wealth fund, or even top hedge fund can manipulate the price movements of major currency pairs in the long term. Even if a giant occasionally attempts to intervene in short-term prices, the market's self-regulating mechanism quickly dilutes or even eliminates its impact. More importantly, the core drivers of the foreign exchange market—including national interest rate decisions, inflation data, non-farm payrolls, geopolitical conflicts, and central bank policy shifts—are almost entirely derived from publicly available, authoritative, and globally synchronized macroeconomic information. This means that retail investors and institutions are essentially on the same starting line in terms of information access, without the layers of obscurity found in the stock market.

Therefore, the essence of forex trading does not rely on secret "insider information," but rather tests a trader's grasp of macroeconomic rhythms, perception of market sentiment, disciplined risk control, and depth of understanding of currency pair dynamics. Furthermore, its T+0 mechanism, lack of price limits, and support for two-way trading allow traders with smaller capital to leverage their agility and seize opportunities amidst volatility. With a clear strategy, rigorous risk control, and resolute execution, retail investors can absolutely achieve steady returns in this market. In short: the stock market often uses "news" as bait to create information traps, a typical cognitive harvesting ground; while the forex market uses "strength" as the yardstick, measuring systems and mentality, a truly open, transparent, and fair competitive arena. The investment cultures, survival rules, and paths to success fostered by the two are worlds apart.

In the forex two-way trading market, some traders have misconceptions about short-term high-frequency trading.

Blindly chasing high-volatility currency pairs and related investment products, they fail to realize that such trading activities primarily contribute to the trading platform's profits rather than creating real value for themselves. The high volatility of high-frequency trading inherently contains extremely high uncertainty. Traders often incur significant costs through frequent operations, yet struggle to control market trends, ultimately becoming "contributors" to the platform's profits rather than "creators" of their own wealth.

It is worth noting that the forex two-way trading sector also harbors "traps" in gold trading. Many seemingly attractive gold trading opportunities are actually a few entities using gold as a "cash cow" for personal gain, rather than a tool to help investors profit. Crucially, gold trading often involves high leverage. While high leverage may seem to offer traders the possibility of "high returns with low investment," it actually significantly increases the risk of margin calls. Many investors mistakenly rely on luck in such high-risk operations, ignoring the potential for shady platform practices hidden behind that luck. This often results in significant losses, with the so-called "hope of profit" proving to be nothing but a mirage.

The notion circulating in the market that "gold and forex are complementary" is largely misleading. This so-called "complementarity" essentially encourages investors to diversify their funds, exacerbating the complexity of trade management and making it difficult for traders to fully grasp the dynamics and risks of each asset class. In reality, whenever a trading platform actively recommends gold trading, the hidden schemes often outweigh the genuine opportunities. Investors should exercise caution and resolutely avoid such gold trading instruments to mitigate risk.

The core survival strategy in forex trading ultimately lies in mastering forex trading itself, rather than chasing seemingly glamorous derivatives. It's crucial to understand that risk and return are inextricably linked; the higher the risk level of forex trading, the more traders must adhere to the industry's ironclad rules. Only by establishing a rational understanding of trading, abandoning wishful thinking, staying away from all kinds of high-risk traps, and adhering to the principle of compliant trading can one gain a foothold in the complex and ever-changing foreign exchange market and achieve long-term stable trading survival.

In the practice of two-way foreign exchange investment, Chinese citizens participating in foreign exchange transactions must first understand the legal boundaries of their actions; this is a crucial prerequisite for risk avoidance.

Most foreign exchange investment transactions involving Chinese citizens are foreign exchange margin trading. Such transactions are not officially recognized in China and lack a mature and comprehensive regulatory body, placing them in a regulatory gray area. From a legal perspective, simply participating in foreign exchange margin trading does not constitute a violation of the law and will not incur criminal liability, as long as one does not act as an organizer, operator, or other core figure in the transaction. There is no need to worry about the risk of criminal prosecution.

According to relevant national laws and regulations, illegal activities in the foreign exchange field are clearly defined. Only those actions that bypass formal banking channels, privately buy and sell foreign exchange to profit from price differences, and disrupt the national foreign exchange management order will be considered illegal foreign exchange activities and subject to legal sanctions. It is particularly important to emphasize that while individual participation in forex trading is not illegal, such transactions are not protected by law. If losses occur during trading, or if one encounters fraudulent trading platforms or absconds with funds, all losses must be borne by the individual, and it is difficult to recover losses through legal channels.

The current forex industry is rife with unscrupulous platforms of varying quality. Selecting compliant platforms is crucial for individuals participating in forex trading. Some unscrupulous platforms often use highly attractive conditions such as "low commissions" or "zero commissions" to lure investors, but in reality, they conceal a significant risk of absconding with funds. These platforms lack the necessary operating qualifications, and their promised high returns are largely unrealistic. Investors must remain highly vigilant, proactively avoid such non-compliant platforms, and strengthen their own financial security.

In the two-way trading scenario of forex investment, Chinese citizens, as potential or actual forex traders, first need to deeply understand the underlying logic and practical considerations behind the government's foreign exchange control measures.

From the perspective of the fit between market size and regulatory costs, China's massive population presents unique challenges to the regulation of foreign exchange investment. Even if policy adjustments bring foreign exchange trading into a legal regulatory framework, the limited trading volume is insufficient to support the smooth operation of the regulatory system. This assessment is not unfounded; actual operating data from the global foreign exchange market provides a glimpse into this—even the two top-tier foreign exchange brokers were acquired for only around $300 million each. This data fully demonstrates the limited profit margins in the overall foreign exchange trading sector and also suggests that market-driven trading revenue alone is unlikely to cover the operating costs of a dedicated regulatory system.

More importantly, against the backdrop of China's steadily increasing comprehensive national strength, the competitive landscape of the international community has undergone profound changes. Some countries, driven by concerns about containing China's development, are taking precautions and deliberately targeting China's development in related fields. In this macro context, if the full opening and development of the foreign exchange investment sector is hastily promoted, and Chinese investors achieve large-scale profits in the global foreign exchange market, major global countries are highly likely to use adjustments to foreign exchange trading rules to specifically curb this trend. This risk is highly certain. Such rule-based adjustments would not only directly harm the interests of Chinese investors but could also add additional obstacles to the internationalization of the RMB. From a strategic risk-averse perspective, temporarily slowing down the full opening of the foreign exchange investment sector could, to some extent, reduce international attention, decrease unnecessary targeted suppression, and create a relatively stable external environment for the advancement of core strategies such as RMB internationalization.

A trend, once formed, is not easily changed; this does not apply to the trading logic of current mainstream currency pairs.

In the two-way trading mechanism of the foreign exchange market, investors are often guided by the widely circulated trading adage: "A trend, once formed, is not easily changed." However, this concept has shown significant limitations in contemporary foreign exchange investment practice, and it can even be said that it is not applicable to the trading logic of current mainstream currency pairs.

The reason for this lies in the fact that frequent intervention in the foreign exchange market by central banks around the world has become the norm—the core purpose of which is to prevent the formation of a sustained and clear trend in their currency exchange rates. This systemic policy intervention has kept major global currency pairs in a state of range-bound or consolidation for a long time, making it difficult to foster truly unilateral market movements.

In fact, as early as the beginning of the 21st century, a widespread consensus gradually formed in the market that "foreign exchange trends are dead." This judgment was not unfounded, but based on observations of profound changes in macroeconomic policies and market structures. The most symbolic event was the closure of the globally renowned foreign exchange hedge fund FX Concepts—this institution, once known for its trend-following strategies, ultimately withdrew from the market, seen as a landmark footnote to the "end of the trend trading era." Since then, few large foreign exchange funds with global macroeconomic trends as their core strategy have risen again, and no new institutions have been able to replicate their former glory in this field.

Today, the foreign exchange market is more of a collection of policy games, short-term fluctuations, and mean reversion, rather than a stage for trend traders to calmly position themselves. Therefore, investors who remain obsessed with capturing so-called "major trends" risk falling into a strategic predicament disconnected from reality. Only by adapting to structural market changes can they find a stable path amidst complex and volatile exchange rate fluctuations.

In the two-way trading scenario of foreign exchange investment, Chinese citizens, as foreign exchange investors, should resolutely avoid participating in the operation and practice of any foreign exchange-related industries.

The core premise of this avoidance principle is that the practices of such industries themselves violate the requirements of current Chinese laws and regulations, and are generally subject to extremely high operational risks, lacking the foundation and guarantee for sustainable development.